Confirmation Bias and Rent Pricing

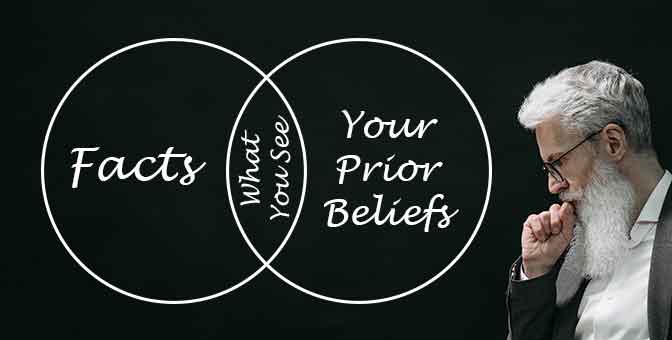

Do you have preconceived notions of how something should be? We all do, and sometimes we are not even aware of them. Behavioral economists, academics, and psychologists have performed intriguing work to uncover the unique, frequently unconscious biases that lead to suboptimal, or even poor, decisions. By extension, confirmation bias may also affect rent pricing decisions.

Practically speaking, these biases serve as a coping strategy or shortcut that enables people to act quickly in the face of a deluge of information.

What is confirmation bias?

When someone deliberately seeks for, reads, or remembers information that supports a preexisting viewpoint, they exhibit confirmation bias and place more weight on that information over other available evidence.

A fascinating study was carried out by Stanford researchers Charles G. Lord, Ross Lee, and Mark R. Lepper using undergraduate students who had different opinions on the death penalty. These researchers asked students to assess fabricated studies on the death penalty. The researchers also presented these studies as legitimate.

One fictitious study contained data that supported the belief that the death penalty deters crime. The other fictitious study contained data that supported the idea that the death penalty has no discernible impact. The researchers carefully created these made-up studies to portray equally both sides of the debate with “objective” statistical “facts”.

The researchers found that students who initially believed the death penalty was an effective deterrence also believed the deterrent study to be credible and the non-deterrent study to be unreliable. The exact opposite was true for individuals who opposed the death penalty.

In other words, students were more likely to accept and believe the research that confirmed their beliefs. It’s interesting to note that after viewing both studies, students solidified their pre-existing opinions even more.

How can confirmation bias affect the store operator?

Store operators might also have preconceived beliefs about the worth of their facilities and the prices they think customers will tolerate. Confirmation bias can cause operators to seek information that confirms their existing opinions while ignoring evidence to the contrary. Operators may be unable to accurately determine the customer’s willingness to pay due to this bias.

For instance, we have observed store operators and self-storage executives selectively recall instances where rent increases above “X percent” result in “lots of customers moving out leading to occupancy declines”. Whereas below that threshold, occupancy is minimally affected.

Despite data indicating real behavior to be quite different, this “X percent” now becomes “the magic number” that rent hikes should not surpass, as vowed by the operator or executive.

If indeed the operator keeps rents below “X percent” and occupancy remains high, that could also mean rents may be too low. So the operator may be leaving money on the table. In fact, sometimes lowered occupancy rates may be desirable, especially in the face of increased demand for higher rents down the road.

Rather than relying on preconceived biases and “rules of thumb”, utilize data-driven techniques, processes, and systems as a business best practice. This can help inoculate you from confirmation bias to rent pricing. This data could contain information about your competitors, occupancy rates, and other crucial data directly affecting your business.

This data can aid in determining if more aggressive, or conservative, pricing actions are appropriate than you might otherwise decide to adopt. Not only is it crucial to gather and use the right data, but doing so may even be necessary to succeed financially in marketplaces rife with competition.